Stripe’s ability to be setup in a matter of minutes, a large number of integrations available and ability to customise has seen it quickly become one of the most popular online payment providers.

But if you’re using Xero & Stripe you’re going to quickly notice a couple of issues that need to be addressed.

The first issue is that Stripe only deposits into your bank account the net amount you receive from your customers AFTER their fee has been deducted. This doesn’t cause a huge issue if you’re invoicing from within Xero and using Stripe as your payment service.

Setup correctly at the time of payment, Stripe will apply payment to the invoice being paid and create the fee in your Xero file. You just need to match the Stripe bank deposit with the invoice payment & fee transaction and your done.

But what if you aren’t invoicing from Xero & using stripe as your payment provider?

What if you’re using Stripe as a payment provider for your online store and potentially processing lots of transactions?

Or you’re invoicing via a 3rd party app that’s then generating invoices in your Xero file for accounting purposes, but all you see is the final Stripe deposit that could consist of multiple invoice payments?

You can quickly see how these scenario’s will cause issues for your reconciliation process.

Fortunately, there’s a couple of solutions available for you – each has their benefits and use cases. Let’s take a look at each.

Bankfeeds.io

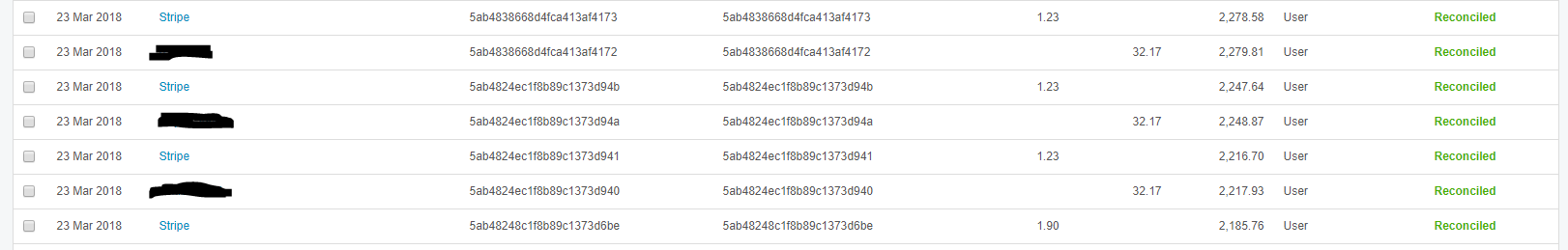

Bankfeeds.io takes your Stripe payments, fees and transfers and creates a bank feed of data in you Xero file that’s reconciled to the settings that you establish from withing Bankfeed.io. Basically, you tell Bankfeeds.io where you want each of the transactions types to be reconciled to in your chart of accounts and the tax treatment to be applied and that’s what Bankfeeds.io will do for you. Transactions come through looking something like this:

You’ll see that transactions are already reconciled to the accounts you’ve selected – there’s literally nothing for you to do.

It’s obviously important that you get your settings setup correctly in Bankfeeds.io to avoid any issues. Take extra care when considering if there’s already any other sources already pushing sales transactions into your Xero file e.g. your online store or inventory management system.

We think this is a good solution for ecommerce businesses or online subscription businesses – but potentially doesn’t have many applications beyond this.

Silver Siphon

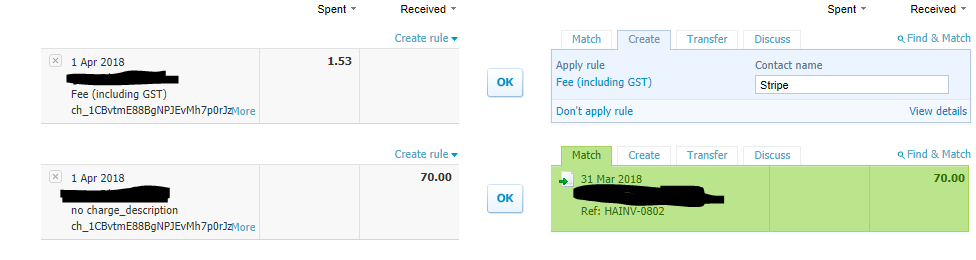

Silver Siphon differs from Bankfeeds.io in that it generates a bank feed in your Xero file just like any other typical bank feed, with transactions ready to be reconciled. The great thing about this is that it provides you with all the normal Xero reconciliation processes that your used to such as establishing rules (perfect for your Stripe fees – then just cash code them regularly) and then auto matching to invoices.

Your Stripe bank feeds comes into your Xero file looking like this:

As mentioned, we think this is a really good solution for businesses that perhaps aren’t doing as high volume of invoicing and aren’t invoicing via Xero but want to be able to import their Stripe data for simple reconciling.

For around the $10/month mark both systems can provide your business with efficiency gains if you’re using Stripe as your payment provider.

Thanks for this Daniel, It was really helpful to stumble on it!

I have now tried both in two different businesses. The first is an eCommerce business – bankfeeds.io performed significantly better than silver siphon – both in speed (instant) to populate Xero and also efficiency – once setup, I didn’t need to do anything, all reconciled automatically. Silver siphon really fell over on the automation part, yes can press a lot of OK clicks or cash coding to speed it up though.

In a SaaS company, we have all our invoices go into Xero that we automate. Bankfeeds cannot reconcile against Xero invoices, so this is where Silver Siphon really works well.

My only concern was it seems like Silver Siphon is logging into my Xero account every day to upload data. This makes me a little nervous. I would prefer it just used the API connectors so there is not a risk of data breach. Also strangely, the ecommerce business is doing more transactions, but is costing me less than the account using Silver siphon.

Hi Michael – glad you found the article helpful, and I 100% agree with you that the businesses you’ve spoken about it seems that one is better suited to Bankfeeds.io and the other Silver Siphon. Great to hear you’ve managed to get it working nicely!